There are significant new opportunities in activity management and organizational analytics, and they’re opening the door for content/collaboration innovation. Several popular startup vendors have introduced offerings that move beyond basic services for messaging/communication and content sharing/collaboration, and Microsoft is offering a rapidly-expanding set of related tools in Office 365, including Planner and Delve Analytics. These new tools can help people gain insights and get work done, but they’re only effective if the requisite content and collaboration resources are available in Office 365, creating a strategic need for a multi-source content/collaboration migration solution.

Building Beyond the Basics

Most enterprises have deployed a wide range of tools and services to address their communication, collaboration, and content management needs. As the foundation-level services are increasingly standardized and commoditized, there’s a growing emphasis on tools and services that make it possible to gain more immediate business value by directly addressing activity management and organizational analytics.

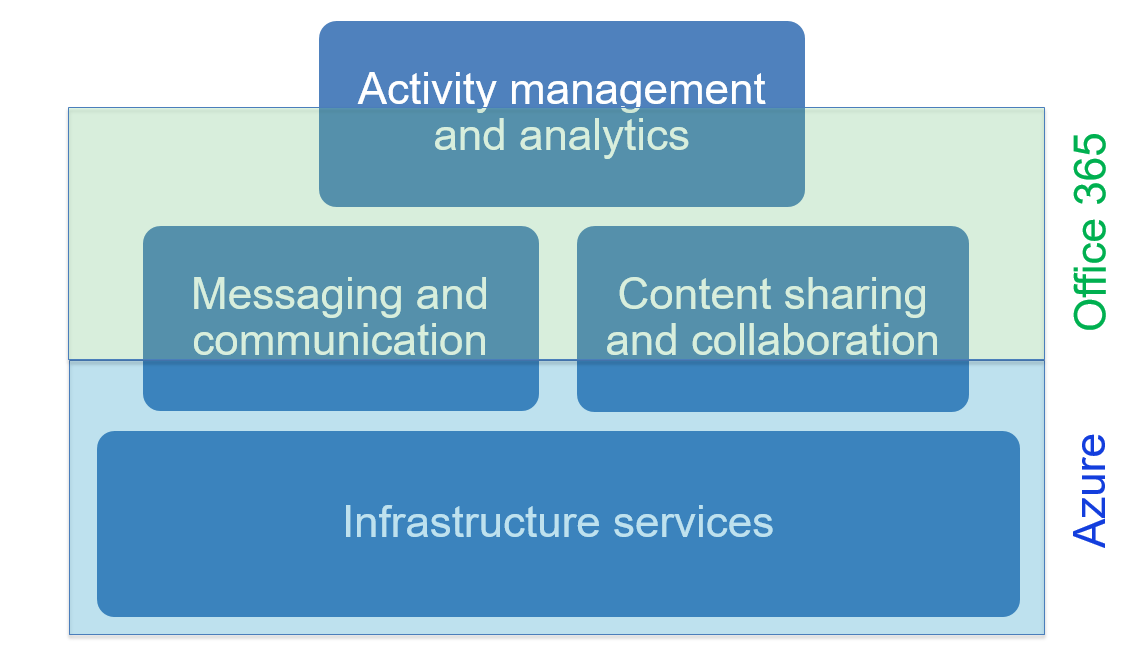

The diagram below is a simplified depiction of the relationships among three categories of complementary tools & services:

Complementary Tool/Service Categories

Many small- to medium-sized organizations, especially technology-centric startups, currently use a mix of tools and services from multiple vendors for the different categories, such as:

-

Gmail and Slack for messaging and communication (for more Slack details, see our earlier post, How Slack Complements Office 365)

-

Box, Dropbox, or Google Drive for file-centric content sharing and collaboration

-

Asana, Basecamp, Trello, and other relatively lightweight activity and project management tools for activity management (lightweight in comparison to specialized project management tools such as Microsoft Project)

Organizations using this sort of multi-vendor approach today are probably not doing much with organizational analytics, because their related data is spread across disparate systems managed by multiple vendors; it would require significant effort to build and maintain a fully integrated analytics-oriented view of activities across the various systems.

Microsoft’s Gestalt Strategy

Microsoft, in contrast to the vendors focused on small- to medium-sized organizations, is placing a strategic bet on the gestalt value of the integrated tools and services in Office 365. Its offerings are being expanded with an eye to centralizing data and productivity apps under the umbrella of Office 365, and building an integrated tool suite that removes the need for a multi-vendor approach.

For communication, this means making a range of tools available for use in different contexts. Messaging and communication in Office 365 includes email (Outlook/Exchange), Skype, Office 365 Groups (with conversations hosted in Exchange), and Yammer.

For content sharing and collaboration, Office 365 offers OneDrive, OneNote, and Sites (with the latter based on the SharePoint model). Delve provides a unified discovery and search tool that works across multiple Microsoft content repositories, including ones focused on communication as well as content-based collaboration (Exchange, Skype, and Yammer as well as OneDrive, OneNote, and Sites) and app-specific repositories (e.g., Microsoft Dynamics). Delve also offers the option to integrate with non-Microsoft apps and services such as Salesforce.

Microsoft has also, over the last two years, introduced several new Office 365 tools focused on activity management and organizational analytics.

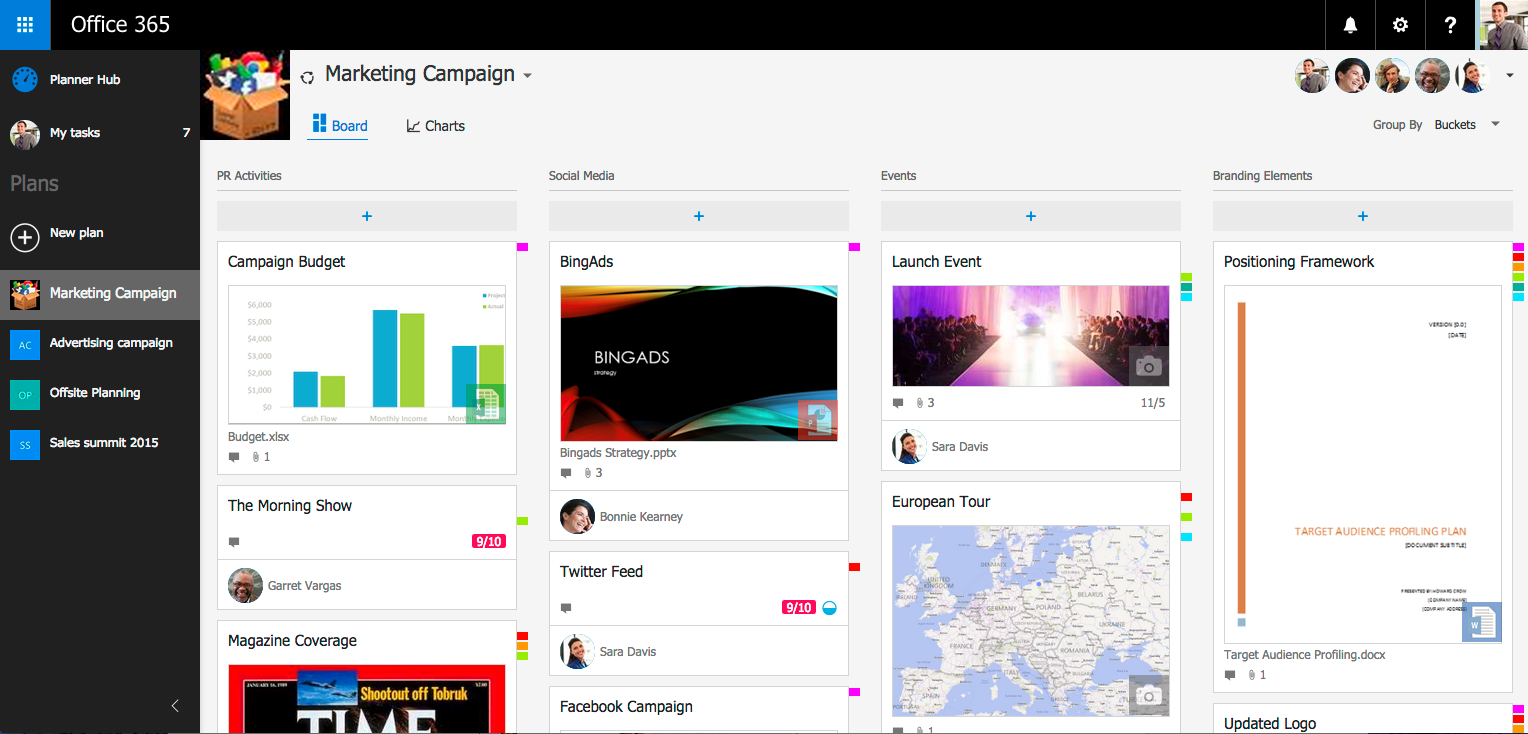

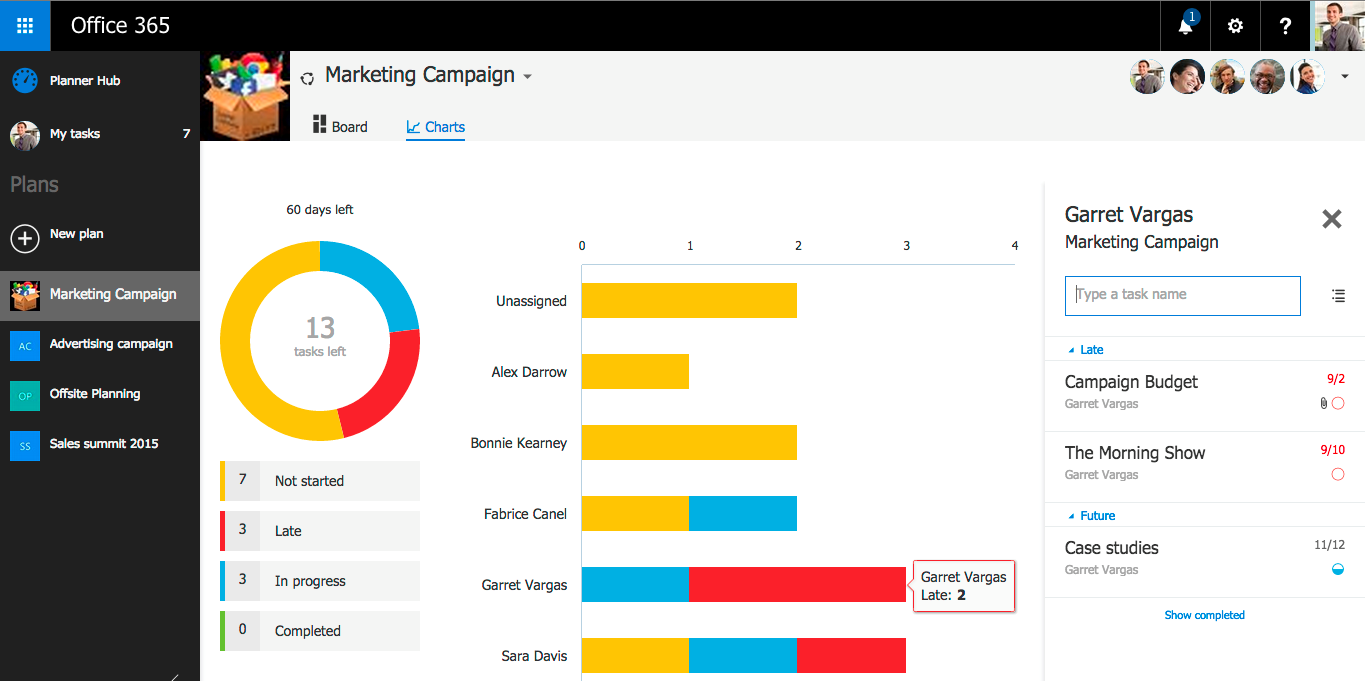

Office 365 Planner is a new tool that’s similar to Trello in several respects. It builds on Office 365 Groups with the ability to organize tasks into plans, along with task assignments and due dates. Here are two Planner user experience view examples from a Microsoft blog post titled Introducing Office 365 Planner:

Marketing Campaign Tasks Managed in Office 365 Planner

An Office 365 Planner Chart View for a Marketing Campaign Plan

Planner extends Office 365 Groups; each plan, for example, has a related conversation, OneDrive folder, and OneNote notebook. Plans will also be immediately familiar to users who have worked with Delve boards, as there is significant user experience overlap. For more Planner details, see Organize teamwork with Office 365 Planner.

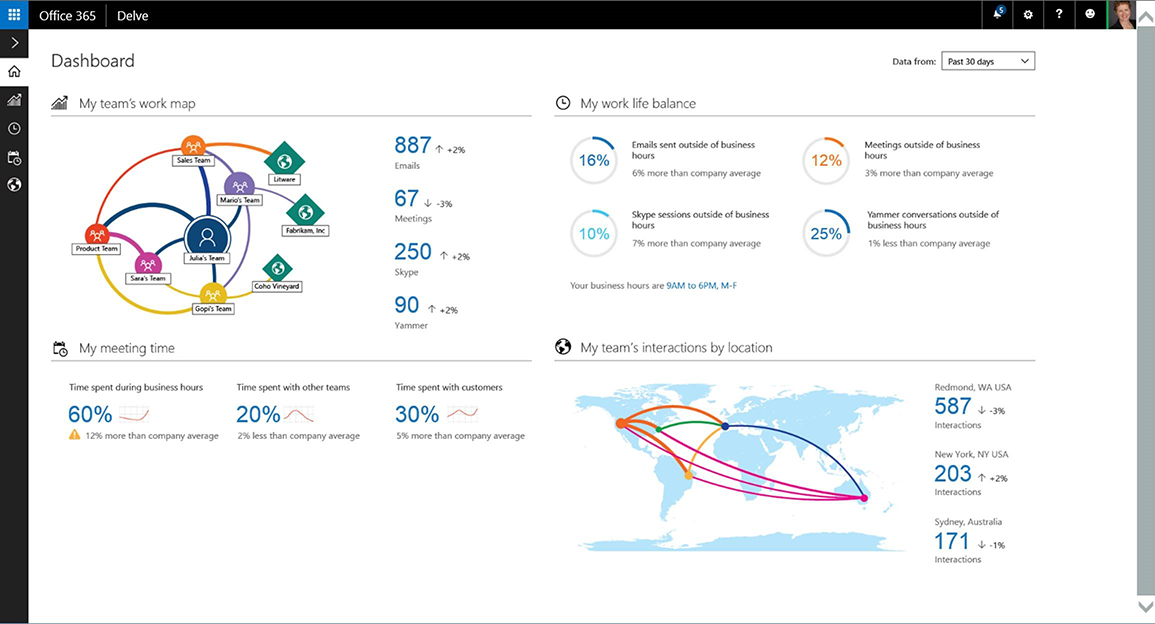

Organizational analytics is another major Office 365 focus area. Microsoft unveiled its initial organizational analytics offering at Ignite 2015 last May, with Delve Analytics. An example Delve Analytics user experience view:

Microsoft Delve Analytics Personal Dashboard (source: Ignite 2015 press release)

In this example, a user is able to track their email, meeting, Skype, and Yammer activities, to compare their activity patterns relative to others in their work group, and to see the other group members with whom they’ve interacted the most.

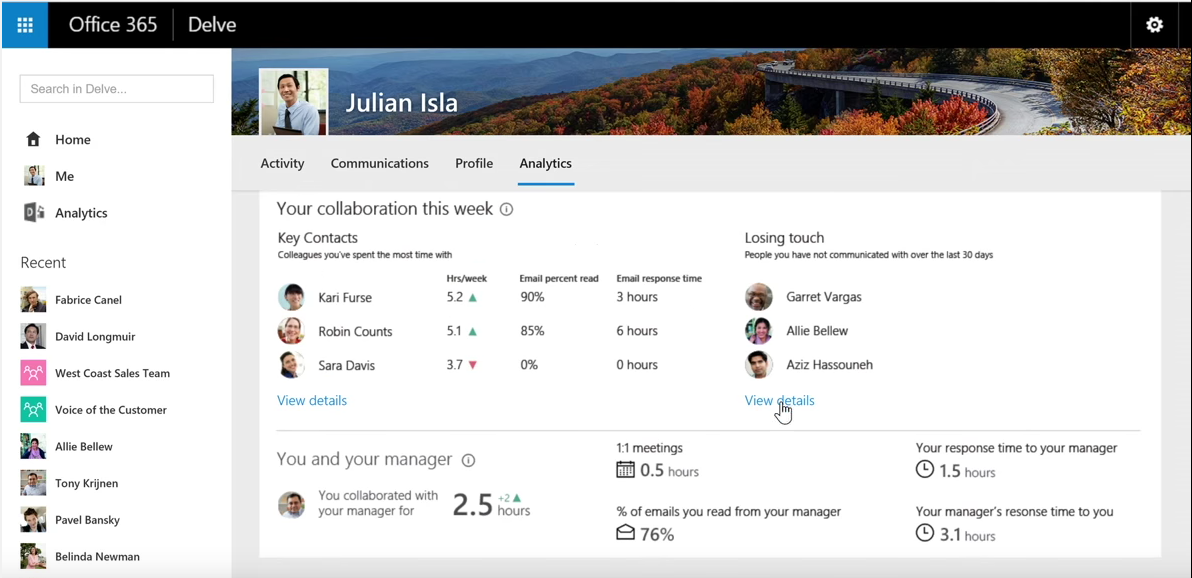

A second Delve Analytics user experience example, highlighting other analytics that can be used to gain insights from personal work activities:

Delve Analytics Collaboration View (source: Meet Delve Analytics)

Microsoft also expanded the scope of its organizational analytics capabilities by acquiring VoloMetrix, a domain specialist, last September, and it’s safe to assume that both activity management and organizational analytics will be high on the agenda for Ignite 2016 later this year.

While these examples are easy to understand, there’s quite a bit of complexity in the supporting Office 365 system architecture. Office Graph is the primary data source for Delve Analytics, and it provides a unified data repository for all activity tracking. Conceptually, Office Graph is a graph database of people, content resources, and related activities, as suggested in this graphic:

A Microsoft Graph Example (source: Microsoft How Does Office Delve Knows What’s Relevant to Me?)

To elaborate on the three tool/service categories referenced earlier in this post, consider this high-level model of Microsoft tools and services:

Microsoft Tools and Services in Azure and Office 365

Where Azure covers infrastructure services with some messaging/communication and content sharing and collaboration services, Office 365 adds more messaging/communication and content sharing and collaboration services, while also addressing activity management and analytics needs. Azure plays a huge supporting role for Office 365, providing infrastructure services for identity, authentication, authorization, and a range of governance needs, along with core compute, storage, and network services.

Office 365 builds on that support from Azure to provide a wide range of tools and services for messaging and communication, content sharing and collaboration, and activity management and analytics domains. It’s a cumulative build, with the activity management and analytics tools adding business-focused capabilities based on content and activities handled in the underlying communication, content, and collaboration layers. With acquisitions such as VoloMetrix and nearly a year’s worth of engineering since Delve Analytics was introduced at Ignite 2015, it’s likely Microsoft’s tool and service portfolio will continue to expand, eventually addressing the full activity management and analytics market landscape.

The Multi-Source Migration Imperative

A key consideration, when contemplating the significant power of Office 365 to help gain insights and get work done, is that tools such as Planner and Delve Analytics are only useful if enterprise content resources are managed in Office 365 and indexed by the Office Graph. For most enterprises, that’s not the case today, as most legacy content and collaborative apps are spread across traditional on-premises platforms such as SharePoint and Lotus Notes as well as first-wave Internet content storage and sharing services such as Box, Dropbox, and Google Drive, which have been used for huge collections of enterprise files.

The CASAHL DART product suite is optimized to address multi-source content/collaboration migration needs. With a single solution, enterprises can assess their existing deployments across a wide range of legacy platforms and services, determine which resources are still useful (reducing the overall migration load by up to 65%), and securely migrate resources to the most appropriate Office 365 tools and services. CASAHL also offers a set of services that make migration projects low-risk, cost-effective, and fast.

To make the most of the exciting new Office 365 activity management and organizational analytics capabilities while consolidating and optimizing enterprise content and collaboration resources, contact CASAHL today to get started.